An IMGW Report

Plans to abolish the ‘non-dom’ regime by both major political parties have prompted many wealthy foreigners to consider leaving the UK. Increasingly popular destinations include Italy, Switzerland, Malta, and the Middle East.

An increasing number of wealthy foreigners are leaving the UK in response to the abolition of the ‘non-dom’ regime, which allowed them to avoid paying tax on overseas income. This change, supported by both the Conservative and Labour parties, has contributed to a decline in the UK’s attractiveness. Other reasons for departure include Brexit, fiscal and political instability, and security concerns.

“The 2024 World’s Wealthiest Cities Report, published by Henley & Partners, highlights that London, once the wealthiest city globally, has dropped to 5th place, with a 10% decline in millionaires over the past decade. Currently, London hosts 227,000 millionaires, 370 centi-millionaires, and 35 billionaires.“

A billionaire businessman who has lived in London for 15 years and is moving to Abu Dhabi said, “Brexit happened, and the Conservatives promised to make the UK like Singapore, but instead, they turned this place into Belarus. Security is now a major issue alongside the tax reasons for leaving.”

In March, Chancellor Jeremy Hunt announced the abolition of the non-dom regime, a policy initially proposed by the Labour party. Labour shadow chancellor Rachel Reeves proposed further toughening the crackdown by reversing a decision that allowed non-doms to shield foreign assets in an offshore trust from inheritance tax permanently.

Polls indicate a potential Labour party victory in the general election on 4 July. A European non-dom businessman moving from London to Switzerland after over a decade in the UK cited the 40% inheritance tax on global assets and overall instability as key reasons for leaving.

While Labour has committed not to raise income tax, national insurance, corporation tax, or VAT, it hasn’t ruled out increasing capital gains tax or inheritance tax. Reeves stated, “We’re not seeking a mandate to increase people’s taxes.”

Trevor Abrahmsohn, director of Glentree Properties, noted a decline in inquiries for £10mn properties due to “higher interest rates and anticipated changes to the non-dom regime.” As more high-end properties come onto the market, he expects fewer buyers and a fall in prices.

Indian vaccine billionaire Adar Poonawalla mentioned that the non-dom change has harmed the UK, and many are unwilling to bear the cost and are moving out. HM Revenue & Customs reported 68,800 individuals claiming non-dom status in 2022, but recent data on departures is lacking.

Fiona Fernie of Blick Rothenberg highlighted a buzz around people considering leaving due to the targeting of non-doms by both parties. A French investor moving to Milan in early 2024 praised Italy’s system that exempts foreign income from tax for a €100,000 annual payment.

The non-dom regime crackdown began under Conservative Chancellor George Osborne. Other European jurisdictions like France, Italy, and Portugal have since introduced comparable regimes to attract wealthy families, increasing competition with Monaco and Switzerland.

Proponents of the non-dom regime argue it brings skills, jobs, and investment to Britain. The American School in London is concerned about future enrolment due to the non-dom abolition.

A French businessman in Switzerland, initially considering moving part of his business to the UK, reversed his decision after the non-dom abolition announcement. He stated, “The Conservatives have sent a strong signal that they don’t want foreigners here anymore, and Labour won’t change that.”

Fears of a tougher tax regime are also causing some UK nationals to consider leaving. Henley & Partners reported a three-fold increase in inquiries from UK nationals between 2022 and 2023 and a 25% year-on-year increase in the first half of this year. Dominic Volek of Henley & Partners attributed this to concerns about a potential Labour government.

Wealth Trends and Migration Patterns

The 2024 World’s Wealthiest Cities Report, published by Henley & Partners, highlights that London, once the wealthiest city globally, has dropped to 5th place, with a 10% decline in millionaires over the past decade. Currently, London hosts 227,000 millionaires, 370 centi-millionaires, and 35 billionaires.

By contrast, other cities have experienced significant growth in their wealthy populations. New York City remains the wealthiest, with a total wealth of over USD 3 trillion and 349,500 millionaires. The Bay Area, including San Francisco and Silicon Valley, is the second wealthiest, having increased its millionaire population by 82% over the past decade.

Singapore has also climbed the ranks to 4th place globally, with a 64% increase in millionaires over the past 10 years, making it a top destination for wealthy migrants. Approximately 3,400 high-net-worth individuals moved to Singapore in 2023 alone.

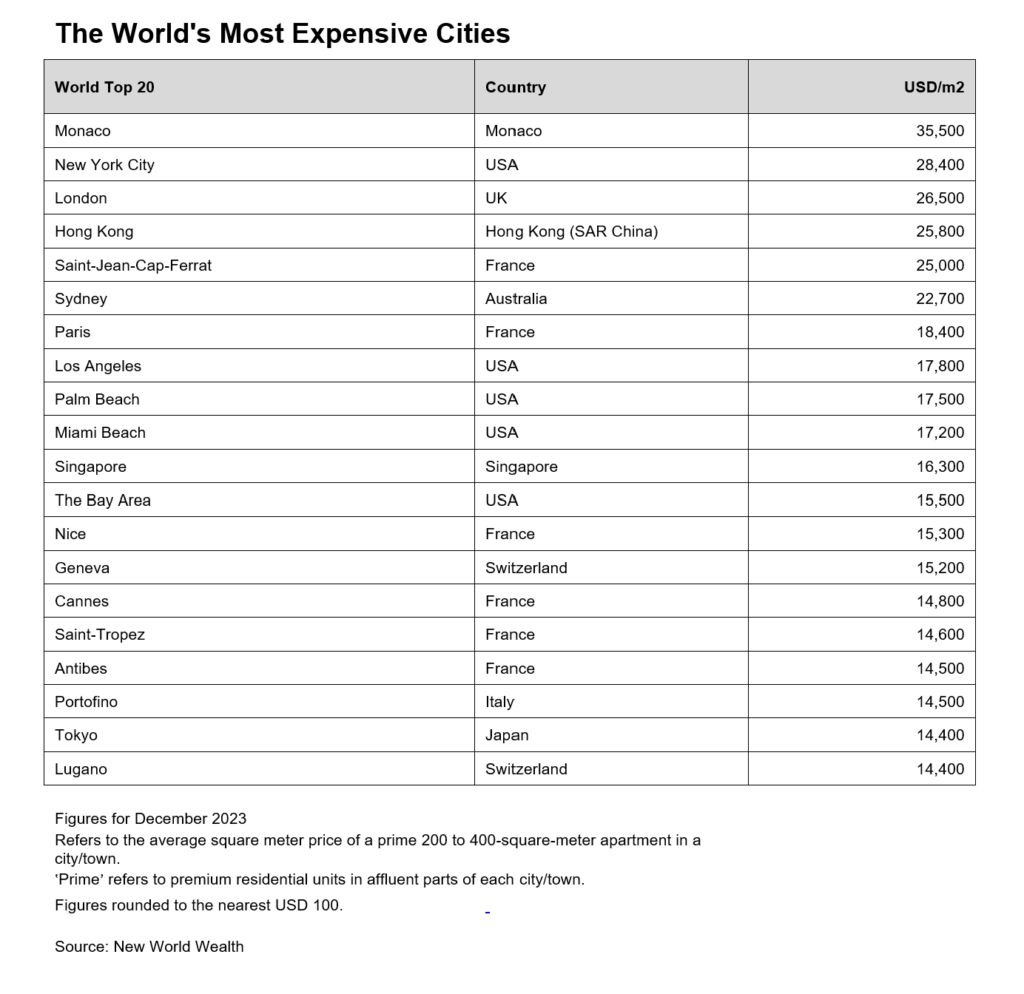

Despite London’s decline, it remains one of the most expensive cities in the world, with prime real estate prices averaging USD 26,500 per square metre.

Source: 2024 World’s Wealthiest Cities Report, Henley & Partners.