The Use of AI in Compliance and Due Diligence

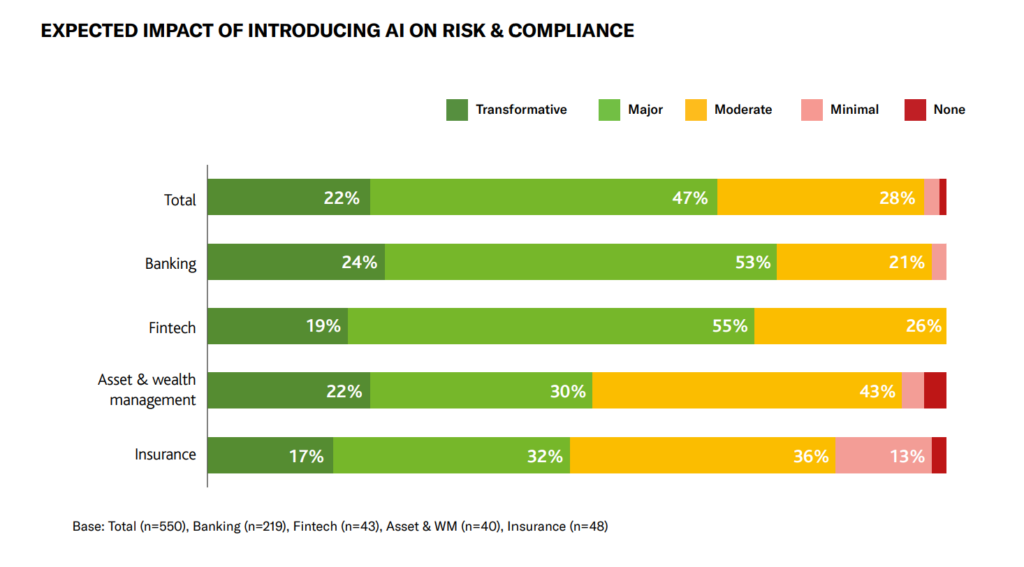

An IMGW ReportMoody’s Analytics* conducted a global study last year on AI in Risk and Compliance, which included the expert opinions of over 500 participants. The results help shed light on the transformative impact of AI on compliance and due diligence processes, highlighting its benefits, current adoption trends, and the challenges faced by organisations in implementing these technologies.

According to the report “Navigating the AI Landscape,” published by Moody’s Analytics in 2023, “AI technology has many facets, as listed by the experts who were interviewed for this study. AI solutions range from machine learning to robotics to large language models and generative AI”.

This report highlights the transformative impact AI is having and will continue to have on compliance and due diligence processes. This article delves into how AI is reshaping these critical functions, highlighting its benefits, current adoption trends, and the challenges that come with it.

“The report reveals that 79% of respondents believe regulation of AI is important, and 51% emphasise the need for transparency and explainability in AI decision-making.”

Moody’s Analytics

Transaction Monitoring and Risk Detection

One of the primary applications of AI in compliance is transaction monitoring and risk detection. Traditional methods often rely on predefined rules and thresholds, which can miss sophisticated schemes or generate a high number of false positives. AI, particularly machine learning (ML) algorithms, can analyse vast datasets to identify patterns and anomalies indicative of fraudulent activities or compliance breaches.

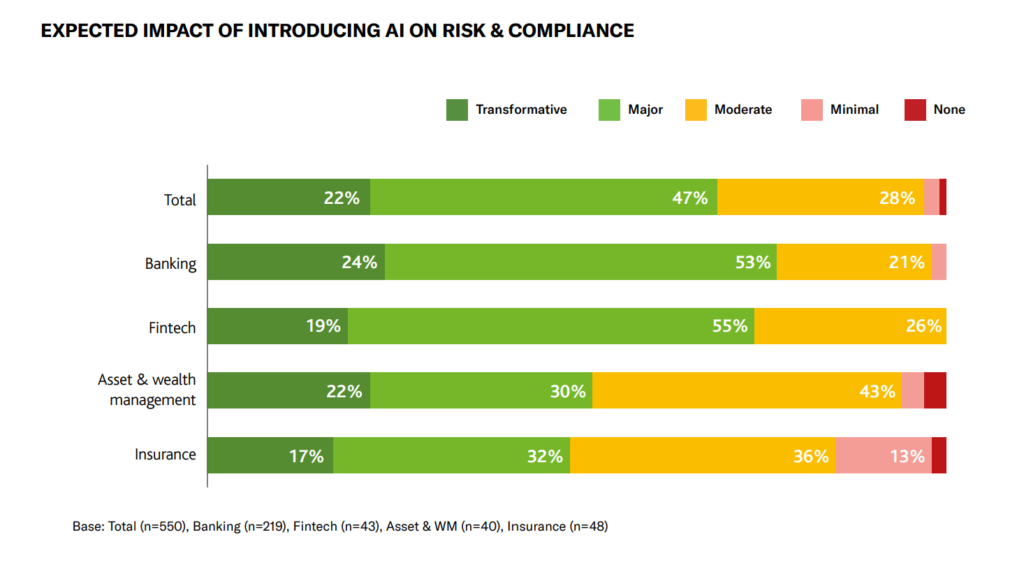

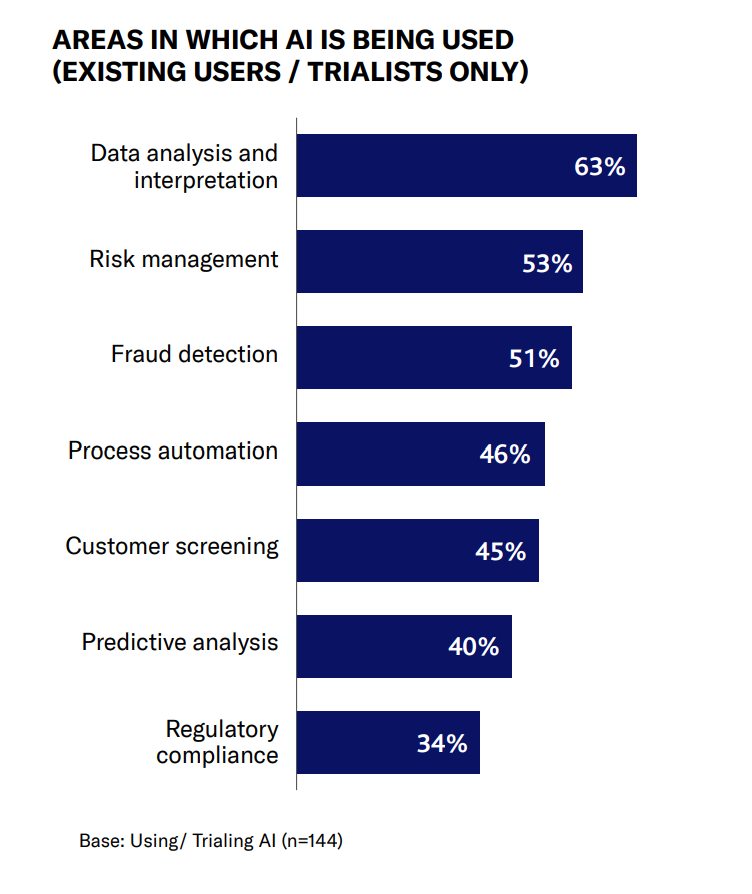

AI excels in identifying risks through advanced pattern recognition, which is particularly useful in anti-money laundering (AML) monitoring and fraud detection. For instance, AI systems can detect unusual transaction patterns that human analysts might overlook. These systems continuously learn and adapt, improving their accuracy over time, which leads to more effective monitoring and reduces the risk of financial crimes. According to the report, 63% of companies using or trialling AI employ it for data analysis and interpretation, while 53% use it for risk management and 51% for fraud detection.

Individual and Entity Profiling

Accurate profiling of individuals and entities is crucial for compliance and due diligence. AI enhances this by analysing diverse data sources to provide real-time insights. AI technologies, such as Natural Language Processing (NLP) and Generative Adversarial Networks (GANs), can process and interpret vast amounts of data from vendors, customers, market trends, and regulatory updates.

AI’s role in customer and entity profiling includes real-time due diligence, compliance gap detection, and predicting outcomes based on historical data. This capability allows organisations to streamline processes, reduce human errors, and minimise expenses, thereby enhancing overall compliance efforts. The report indicates that 45% of organisations use AI for customer screening and 40% for predictive analysis.

Automation and Efficiency Improvement

AI is also revolutionising the automation of repetitive tasks, significantly improving efficiency in compliance and due diligence processes. By automating routine tasks such as document review, compliance-related questions, and regulatory requirement management, AI frees up human resources to focus on more complex and strategic activities.

Generative AI models like ChatGPT can be employed for drafting communications and modelling business scenarios, while AI-driven tools such as GitHub Copilot assist in code and policy reviews. This not only speeds up processes but also ensures consistency and reduces the likelihood of human error. The report shows that 55% of firms using AI in compliance are seeing significant improvements in efficiency, and 91% of early adopters report a positive impact on their operations.

Adoption Trends and Challenges

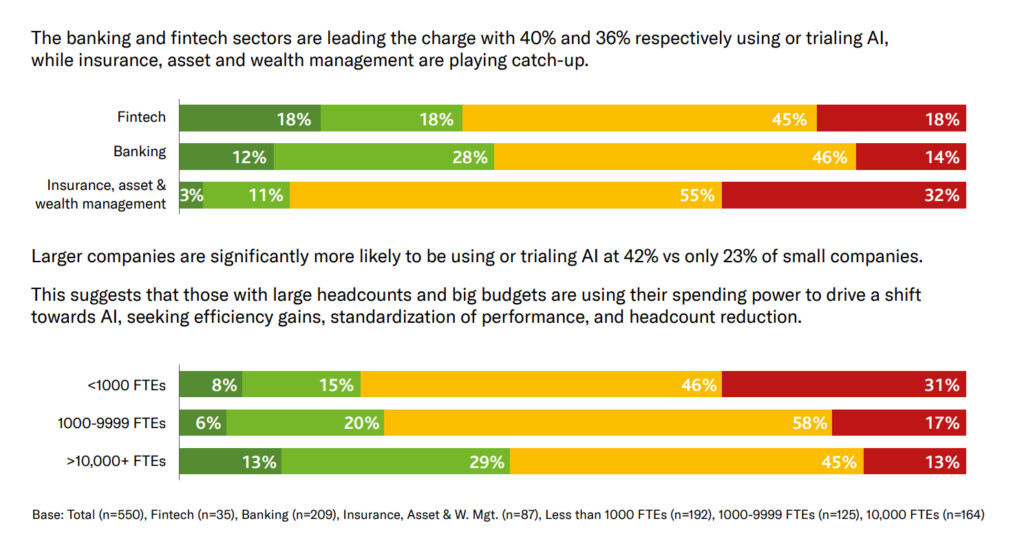

Despite its potential, the adoption of AI in compliance and due diligence is still in its early stages. Around one in three organisations are actively using or trialling AI in compliance and risk management, with the banking and fintech sectors leading the charge at 40% and 36% respectively. Larger companies are more likely to adopt AI due to their greater resources and need for efficiency gains.

A significant barrier to widespread AI adoption is data quality. The report highlights that two-thirds of respondents rate their firm’s data quality in the lowest categories, which hinders effective AI implementation. High-quality, organised data is crucial for AI to function optimally, suggesting that companies need to improve their data management practices to leverage AI fully. Only 36% of those already using AI rate their internal data as high-quality or superior, compared with just 9% of those not considering AI.

Regulatory Considerations

The regulatory landscape is another critical factor in the adoption of AI in compliance. There is a strong consensus among industry leaders on the need for new legislation to govern AI use in compliance and due diligence. Issues such as data privacy, global standards, and the explainability of AI models are at the forefront of these regulatory concerns.

With increased scrutiny on financial services and the recent addition of Investment Migration operatives and professionals as subject entities, obliging them to adhere to more robust due diligence and anti-money laundering regimes (especially in the EU), the application of AI is imperative. Ensuring transparency in AI decision-making, developing comprehensive AI governance frameworks, and regular testing for bias and fairness are key safeguards that industry professionals advocate for. These measures are essential to build trust in AI systems and ensure they are used responsibly and effectively. The report reveals that 79% of respondents believe regulation of AI is important, and 51% emphasise the need for transparency and explainability in AI decision-making.

Conclusion

AI is poised to transform compliance and due diligence by enhancing transaction monitoring, improving profiling accuracy, and automating routine tasks. However, the journey to full adoption is fraught with challenges, including data quality issues and regulatory hurdles. Organisations that can navigate these challenges and effectively integrate AI into their compliance processes stand to gain significant advantages in efficiency, risk detection, and overall operational effectiveness.

The future of AI in compliance and due diligence looks promising, with a broad consensus on its potential benefits. As AI technologies continue to evolve, their impact on compliance and risk management will likely grow, making it imperative for organisations to stay abreast of developments and prepare for a more AI-driven future.

*Moody’s Analytics, a subsidiary of Moody’s Corporation (which also includes Moody’s Ratings), was established in 2007 to focus on non-rating activities. With over 10,000 employees, it is one of the leading firms in its field worldwide. Moody’s Analytics provides economic research on risk, performance, and financial modelling, as well as consulting, training, and software services.

If you enjoyed this IMGW News article you may also find the following of interest:

- Latest EU anti-money-laundering rules will now include “investment migration operators” as new obliged entities.

- Onboarding Unleashed: How AI is Redefining Wealth Management and Investment Migration