The Importance of Scientific Foresight in Business Planning

An IMGW News Feature Report

In an increasingly interconnected and dynamic global economy, the ability to forecast future economic trends through scientific means is essential for businesses, governments, and entrepreneurs. This foresight enables strategic planning, informed decision-making, and the anticipation of potential challenges and opportunities. As we navigate the complexities of the 21st century, understanding long-term economic projections becomes crucial for sustainable growth and competitive advantage.

According to the Organisation for Economic Co-operation and Development (OECD), the global population is expected to surpass 9 billion by 2050, significantly increasing the strain on natural resources vital for energy and food production. This demographic surge, alongside other economic dynamics, underscores the necessity for meticulous economic forecasting to ensure efficient resource management and strategic investments.

Trend #1: Slower Global Growth Due to Weaker Population Growth

Research by Goldman Sachs indicates that global potential growth is expected to decelerate, primarily due to a reduction in labour force growth. Projections suggest that global growth will average just under 3% annually over the next decade and will gradually decline. Over the past 50 years, global population growth has halved from 2% per year to less than 1%, and it is anticipated to approach zero by 2075.

Trend #2: Emerging Markets Continue to Converge, Led by Asia

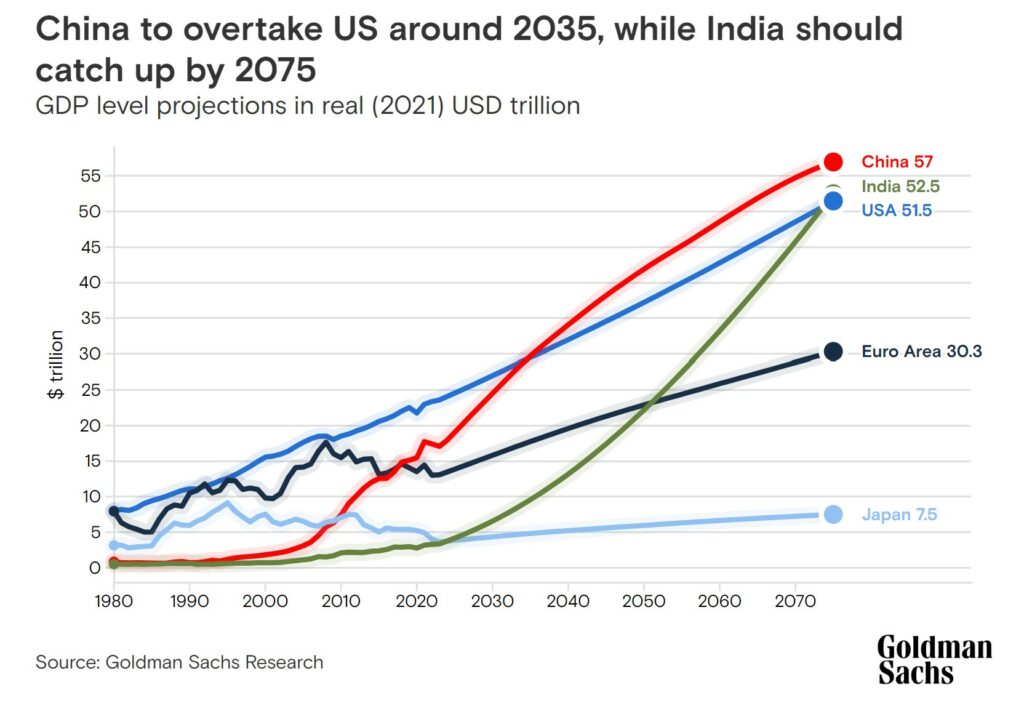

Despite a slowdown in real GDP growth for both developed and emerging economies, emerging markets, particularly in Asia, are expected to continue outpacing developed markets. By 2050, the world’s five largest economies are projected to be China, the US, India, Indonesia, and Germany, with Indonesia displacing Brazil and Russia among the largest emerging markets. By 2075, with the appropriate policies and institutions in place, Nigeria, Pakistan, and Egypt could also be among the world’s largest economies.

Trend #3: A Decade of US Exceptionalism Unlikely to Be Repeated

The US has performed exceptionally well over the past decade. However, this is unlikely to persist in the next decade. US potential growth remains significantly lower than that of large emerging economies. We expect some of the US Dollar’s recent exceptional strength to wane over the next ten years. The appreciation of the Dollar has elevated the US economy’s value, pushing it significantly above its purchasing power parity-based fair value. However, the Dollar’s strength is anticipated to decline in the coming decade.

Trend #4: Decreasing Global Inequality, Increasing Local Inequality

Globalisation has markedly reduced income inequality between countries, resulting in a more equitable distribution of global incomes. However, while income inequality between countries has decreased, inequality within countries has risen, posing a significant challenge to the future of globalisation.

Goldman Sachs’ research also highlights potential challenges for global economic growth and income convergence. Populist nationalism could lead to increased protectionism and a reversal of globalisation. Additionally, the risk of environmental catastrophe due to climate change remains significant. Although many countries have successfully decoupled economic growth from carbon emissions, achieving sustainable growth will require economic sacrifices and a globally coordinated response, presenting significant political challenges.

Emerging Markets Expected to Lead Growth

From 2070-2079, emerging economies are forecasted to grow at 2.3% annually, outstripping developed economies, which are expected to achieve productivity growth of only 1.1%. Asia will remain the fastest-growing region with 2.0% growth, although the Chinese economy is projected to experience one of the highest decelerations. Growth in Latin American economies is forecasted at 1.9%, with gradual acceleration over the next ten years before decelerating again in later decades. Growth in Central and Eastern Europe, the Middle East, and Africa is expected to remain relatively stable at 3.2%, driven by increasing contributions from African economies.

One of the Biggest Companies in Asia

Companies play a significant role as primary economic engines for economies around the world. PDD Holdings Inc. (NASDAQ:PDD), also known as Pinduoduo Inc., is a prominent Chinese company driving economic growth. PDD Holdings Inc. is a multinational commerce group that owns and operates a portfolio of businesses, including Pinduoduo, an innovative e-commerce platform that connects consumers directly with small-scale farmers and offers a network of sourcing, logistics, and fulfilment services. The company also focuses on training farmers and modernising farming practices. PDD Holdings Inc. also operates Temu, an online marketplace that connects consumers with millions of merchandise partners, manufacturers, and brands. Temu operates in several countries, including the United States, Australia, New Zealand, the United Kingdom, Europe, South Korea, and South Africa.

On 22 May, PDD Holdings Inc. reported that its revenue for the first quarter ended 31 March 2024 increased by 131% to $12.02 billion compared to the previous year. The company’s operating profit also increased by 275% to $3.94 billion, mainly due to an increase in fulfilment and payment processing fees. PDD Holdings Inc. forecasts robust revenue growth of 71% for Pinduoduo in 2024, with a further 29% growth expected in 2025. The company focuses on long-term growth and invested $403.0 million in research and development for the modernisation of agriculture and supply chain, thereby reducing its costs. The company has $33.31 billion in cash, cash equivalents, and short-term investments.

While projections indicate a slowing global growth trajectory, emerging markets, particularly in Asia, are shifting the balance of global economic power.

The Largest Economy in the World by 2075

China

- GDP Forecast (2075): $66.16 Trillion

- Estimated Share in the Global GDP (2075): 20.39%

- Population Forecast (2075): 1.02 Billion

China’s economic transformation stands out as one of the most remarkable success stories among middle-income countries. By 2075, China is expected to be the world’s largest economy due to its manufacturing, exports, and investment in technology and infrastructure. China’s GDP is projected to reach $66.16 trillion, accounting for 20.39% of the global economy. China has already surpassed the United States as the largest economy by purchasing power parity (PPP). China’s population is expected to decrease to 1.02 billion by 2075.

By leveraging scientific foresight, businesses, governments, and entrepreneurs can plan more effectively, ensuring they are prepared for future economic landscapes and can capitalise on emerging opportunities.